The residential real estate market continued to evolve through the first half of 2022. Despite anxiety over inflation and increasing interest rates, buyer demand continues to be strong while the number of available homes available for sale remains low. Closed sales are lagging behind 2021 numbers, due to low listing inventory, while sale prices have increased compared to last year.

The Federal Reserve’s interest rate increases and inflation have captured headlines in the past few months. While these are factors worthy of monitoring and analyzing, rate increases and inflation have had less of an impact on local residential real estate sales than most people assume.

Inflation has affected consumer perception as prices for nearly all goods have increased. However, prices for existing homes have increased primarily due to the supply/demand dynamic caused by the listing shortage, not inflationary forces. Listing inventory is showing signs of returning to balance, but we currently have only 1.4 months supply of homes for sale (4-6 months is considered balanced). Costs associated with building new homes have certainly been impacted by inflation. Lumber prices have stabilized in price compared to last year but other building products such as windows, spray foam, garage doors, and paints have experienced price hikes. In addition, labor costs for new construction have escalated because labor has been in short supply. Overall, costs to build a new home have increased from 20% to 25% in the past year. Prices for existing homes have increased around 10% over 2021.

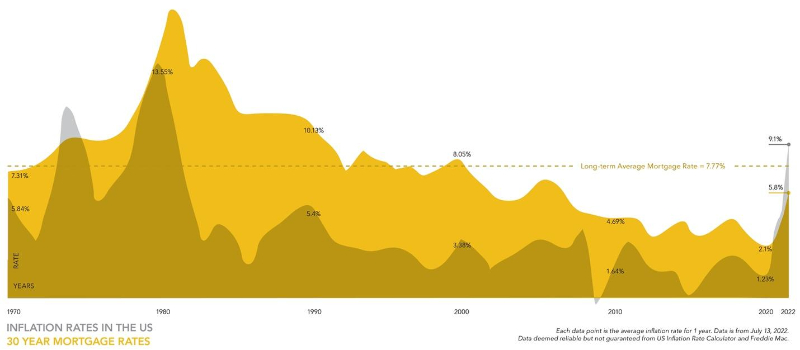

To battle inflation the Federal Reserve has increased interest rates three times thus far in 2022, totaling a 1.5% increase as of now. The Federal Reserve chair has signaled another “appropriate” increase at July’s Fed meeting. This article was written before the July 27th meeting. It is anticipated the Fed will increase interest rates by either 0.75% or 1%. While this is not great news for the residential real estate industry, it has not had a dramatic impact on real estate sales so far. There is still overwhelming demand for housing due to limited supply and, while interest rates have increased, they are still low when viewed from a historical context. The long-term average for a 30-year fixed mortgage rate is around 8%; the current rate for the same loan is below 6%. Many home buyers have had to adjust because they qualify for a smaller amount than before, but most are still planning to purchase a home.

Observations from real estate agents in the field have been that competition for newly listed homes has cooled but it is still a hot market. New listings that are priced and marketed correctly are still selling quickly. I have heard it expressed “it has gone from a red-hot market to a hot market”. Earlier in the year, the market was at a frenzied pace with many listings receiving a multitude of offers, selling immediately, above list prices with terms heavily favoring sellers. We are still in a seller’s market due to low supply and high demand, but the pace and intensity of sales have decreased. While conditions have improved for buyers, it is still a highly competitive environment for those pursuing a home purchase. We are most likely heading toward a “normal” market but at the moment it is still very active by historical standards. Stay tuned for updates on the constantly changing real estate market.