The residential real estate market is changing rapidly as we enter the fourth quarter of 2022. After a decade-long run of robust sales, there appears to be an inevitable correction taking place. Several forces are impacting the changing landscape for residential real estate, most notably the rapidly increasing mortgage rates, high inflation, and decreasing consumer confidence.

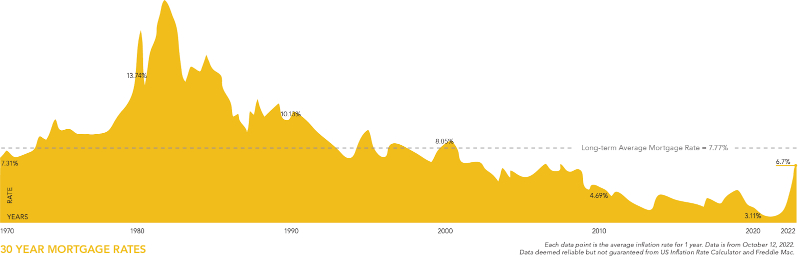

As predicted, the Federal Reserve has increased interest rates rapidly this year to beat back inflation. Nevertheless, the Fed now appears committed to increasing rates to the level that they feel is necessary to cool inflation and regain balance in our economy. So far in 2022, the Fed Rate has increased its target by 3%; it is anticipated that the total increases may amount to 4.5% by the end of 2022. The rapid increase in rates has had a jarring effect on the mortgage industry as refinance applications ceased and mortgage applications slowed. For home buyers, the rates are less attractive than they were earlier, but not devastating. The long-term average for a 30-year fixed conventional mortgage is around 8%, which we have not yet reached. However, buyers have lost purchasing power; for every 1% increase in mortgage rates, a buyer loses 10% of the mortgage amount for which they qualify. For example, if a buyer qualifies for $300,000, for every percentage increase, a buyer qualifies for $3,000 less. Some buyers have adjusted the price of homes they are searching for while others have decided to take a break.

Global events have impacted the US economy. Despite the efforts of the Federal Reserve, inflation has stayed alarmingly high. There is no doubt the Covid-19 pandemic has played a leading role in increased inflation. Initially, the Fed lowered rates to combat the fallout from Covid-19 before anyone knew its true impact. As time went by issues such as supply chain disruption, staffing issues, and production problems drove prices up on nearly all goods. More recently the war in Ukraine has stressed the world’s energy and food supply causing fuel and food prices to skyrocket. Because of these inflationary forces, the Fed will continue to raise rates.

Consumer confidence, which is heavily influenced by interest rates and inflation, is a major factor for home buyers and sellers. Buying a home is not only a large financial decision but also an emotional one. If consumers lack confidence in their finances, they are less likely to make large purchases. Currently, consumer confidence is low, which has quickly slowed down the hot real estate market we were experiencing only a few months ago. As a result, new listings and sales are down dramatically in recent months. Some of that can be attributed to the seasonality of the residential real estate market in the Twin Cities but decreased consumer confidence is the primary culprit.

The shifting market provides opportunities. The overheated market made conditions difficult for buyers, many of whom had to compete with multiple offers, pay premium prices and make concessions to sellers. As the market has cooled, buyers have more time and leverage when purchasing. Many listings are still selling quickly and at close to list prices, but we are seeing fewer multiple offers and more negotiating. The result has been a better balance for buyers. For example, most buyers are conducting home inspections again and are having success negotiating terms that are fair versus heavily favored for sellers. Prices are holding steady and listing inventory is low, which still makes it an appealing time to sell, albeit not as ideal as earlier in the year.

The forecast for the rest of the year has been established, barring a major economic development. We should see a continued increase in mortgage interest rates until inflation is held in check which will slow buyer demand. Because the supply of housing remains low despite the slowing in demand, we anticipate home prices will remain steady with annual appreciation finishing the year around 7%. Despite what one reads in the news, it is not all gloom and doom in the housing sector. We are experiencing a market correction from the era of low interest rates, high demand, and low supply. It seems that we are heading into a period of a “normal” market where there is more balance between buyer and seller.

These are confusing times for most industries and we want to be your resource when you need answers to the housing industry. We hope you have found this newsletter informative, but keep in mind that it only scratches the surface of the current complexities. Most every home is unique and conditions vary based on a variety of factors. If you are looking for answers regarding a home sale or purchase, we encourage you to reach out to us for insight. We go to great lengths to stay informed so that we can be trusted advisors for our clients.