May 2024

It has been another interesting spring for the Twin Cities residential real estate market. Despite relatively high mortgage interest rates and low listing supply, sales have been strong so far this year in our market. Two key factors are the primary focus of attention at this time. The first is that popular predictions that interest rates would decrease during this spring have not come to fruition. The second is the media and industry reaction to the National Association of Realtors (NAR) agreeing to settle a class action lawsuit.

Interest Rates

Last year we experienced an active spring market, but as interest rates increased throughout the summer, we experienced a notable decrease in sales from mid-summer through the end of the year. Many economists were optimistic that the Federal Reserve would begin to decrease the Fed rate early and often in 2024. This was based on the belief that inflation would be lower in the early months of 2024, enabling the Fed to start decreasing interest rates. This did not happen.

There is optimism that rates will still decrease but it will now be later in the year. At the last Federal Reserve meeting in March, Chairman Powell indicated that there would be at least three decreases in the Fed rate by the end of the year. However, nothing is certain regarding interest rates. If the Fed believes inflation is a concern, it will be reluctant to decrease the Fed rate. Lower mortgage rates would be a great benefit for buyers, some of whom have paused seeking a home until rates have decreased. Stay tuned.

The NAR Settlement

Regarding the proposed NAR settlement, there are some aspects of the proposed agreement we are aware of, but there is a lot more that we do not know about yet. The proposed settlement seems firm but has not been approved nor have specific details been released. There has been a lot of media coverage regarding it and too much speculation, in our opinion, from people within and outside the real estate industry. At this point, we only know what we know and while making predictions might be fun, we prefer to convey the facts that are known. We want our customers to know the information that is most valuable to them.

It was not surprising that the lawsuit was settled. The lawsuit that led to the settlement had been looming for several years before going to trial last year. For NAR, the settlement was a business decision; instead of spending time and resources fighting in court, they decided to settle and move forward. However, the timing of the proposed settlement caught everyone off-guard. We suspect this is why the media coverage has been confusing and flawed.

Here are the relevant details, of which we are aware, regarding the proposed settlement:

-

NAR will pay $418 million, over a four-year period, to plaintiffs

-

The proposed settlement is not an admission of guilt or wrongdoing from NAR

The proposed settlement includes two rule changes:

-

Mandating buyer representation agreements

-

Removal of buyer agent compensation from MLS

Buyer Representation Agreements

At Fazendin, we are focused on the proposed rule changes. Fortunately, Minnesota has historically had some of the most consumer-focused rules and practices in the country which will make compliance to the new rules easy. For example, one “new” rule is that buyer agents must have a written agreement with a buyer before showing them homes. Minnesota is 1 of only 12 states that already uses buyer agreements and has had buyer representation in place since the mid-90s. As a brokerage, Fazendin’s business practice is to have buyers review and sign a buyer contract prior to showing homes. We are confident that Minnesota agents will have no problem conforming to this new rule because we have already, voluntarily, implemented it.

Removal of Buyer Agent Compensation from MLS

The rule that will be most complicated to implement is that buyer’s agent compensation will no longer be displayed on the Multiple Listing Service (MLS). For decades, the MLS has displayed the compensation that the listing broker was willing to pay the broker who represented the buyer which ended in a successful closing. This display of compensation on MLS will be prohibited starting in July.

However, there is no prohibition against sellers or listing brokers offering compensation to the buyer’s broker/agent.

It will be interesting to see how much effect this rule has on our industry. We are closely following the repercussions of the proposed settlement and will keep you informed.

As a group, we are on top of this. If you would like more information regarding the proposed settlement, please reach out to us.

Today’s Housing Market

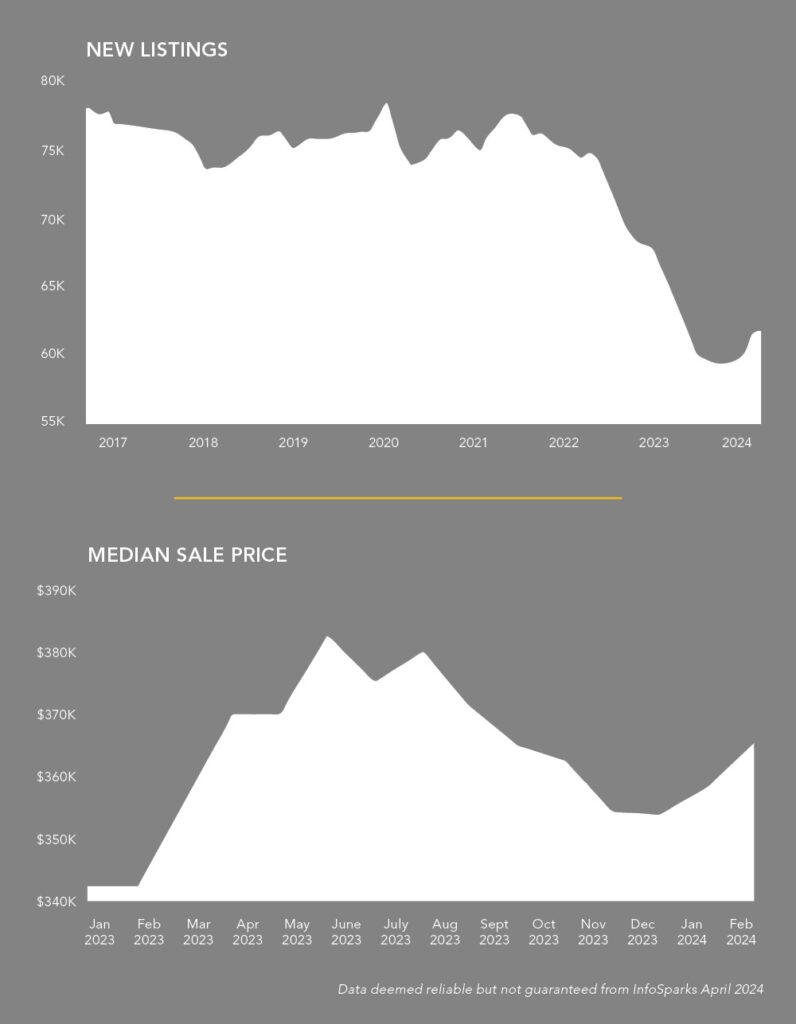

As the market enters the most active time of the year, sales are surprisingly robust despite low listing inventory and higher-than-expected interest rates. Through February, there have been 34.5% more homes listed and 11.2% more closings when compared to 2023. In addition, the median sale price has increased 4.5%. These are indicators of what is to come: an active and competitive real estate market in the coming months.

The three measurables we are watching most closely are mortgage interest rates, median sale price, and new listings.

There is high confidence that interest rates will decline this year, but when and how much they will decline is unknown. And while some buyers are still waiting to buy until rates have subsided, statistics show (11.2% more closings) that the higher rates have not deterred the majority of buyers this year.

Concurrently, after a modest appreciation gain of 2% in 2023, there has been a 4.5% increase in sale price compared to 12 months ago. The lack of new listings, compared to demand, continues to present opportunities for sellers and challenges to buyers.

While we had 34.5% more listings than 12 months ago, last year was an outlier. So far new listing numbers are close to what we have experienced since the pandemic in 2020. Listing supply is low and well below the supply needed to meet buyer demand. We may turn a corner this year with listing supply, but we wouldn’t bet on it. We will continue to track the market so that we can help you reach your real estate goals.

We’re here for you and your real estate needs.

The spring real estate market is rarely dull, and this year is no exception. Fazendin agents take pride in understanding the dynamics that shape the local real estate market. Through collaboration and education with one another and our clients, we can best assist our clients in achieving their real estate goals. We are grateful for your support and trusting us with some of the most significant transactions in life.

Whether or not you plan on buying or selling a home, we are ready and willing to answer your questions.

For more information and general discussion about these class action lawsuits and what they mean for you as a home buyer and seller, please contact us.