There is no shortage of predictions regarding how the 2025 residential real estate market will fare. The consensus from economists, banks, and real estate experts is optimistic regarding real estate sales. This optimism is rooted in the belief that there is pent-up buyer demand after two consecutive years of slumping sales. Aside from the concept of a rebound in sales, the other talking points we’re hearing are not new: listing inventory and mortgage interest rates.

Looking Back at 2024

Before delving into the 2025 real estate market, let’s do a quick review of 2024. The market had potential for a stellar year twelve months ago, mainly based on the belief that inflation would decrease and enable mortgage rates to decrease significantly. Sales were slow to start the year, and it became apparent by mid-summer that mortgage rates were going to remain stubbornly around the 7% range. This kept many buyers on the sidelines and suppressed sales, which led to a disappointing year for the residential real estate industry.

Moving into 2025

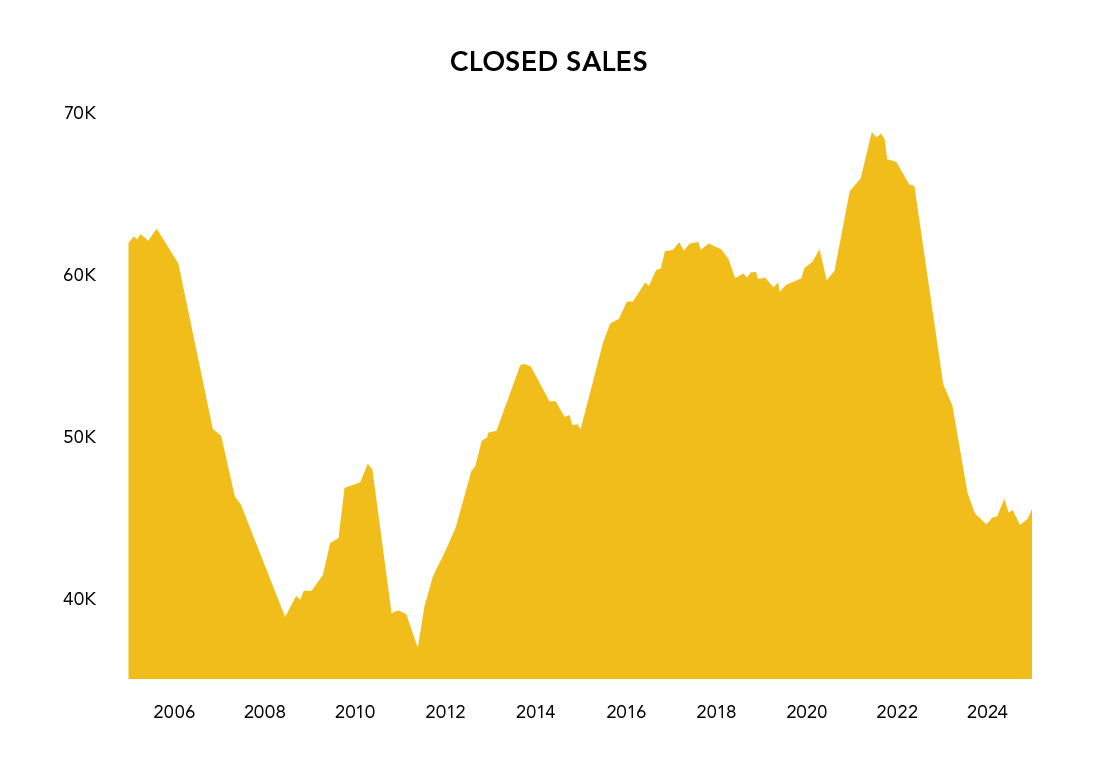

Those in the real estate industry are bullish on the upcoming year. We have searched for tangible reasons for this optimism and have not found an obvious reason. What we have heard is the belief that the number of real estate sales were so diminished in 2023 & 2024 that they will surely increase in 2025. Sales have slumped the past 2 years, with 2023 and 2024 experiencing a decline of roughly 17% compared to the number of closings in 2022.

As you can see from the graph above, there is credence to this. Between December 2021 and December 2024, the number of closings decreased by 47%! Last year, our market recorded just over 45,000 closed sales in the greater Twin Cities metro area; this is the lowest number of closings since 2011. Statistics tend to regress to the mean, and based on buyer demand, many economists are predicting sales will rebound in 2025.

Mortgage Rates

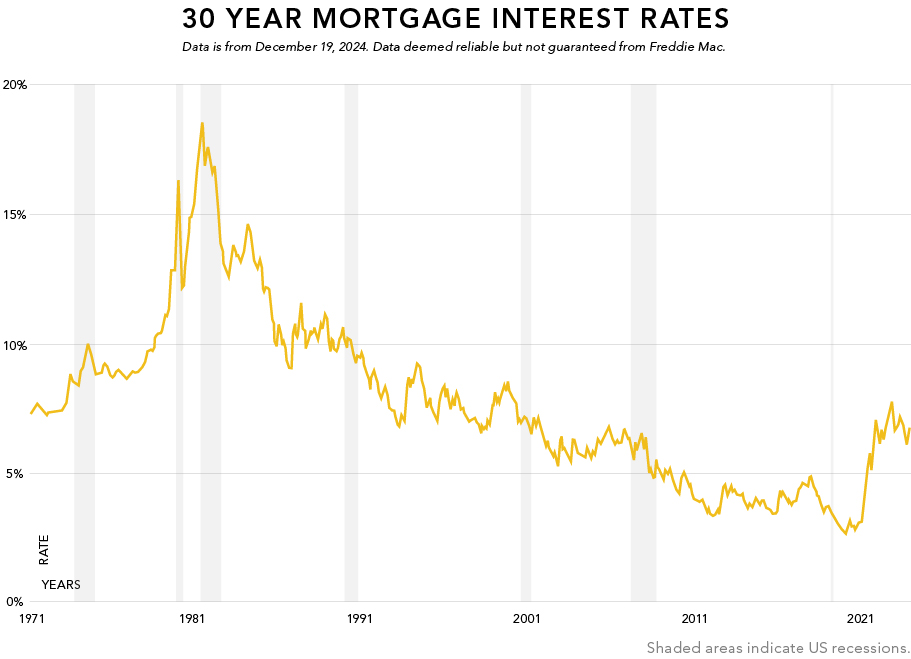

We have learned that predicting mortgage interest rates is a fool’s errand, but we can let you know what we are hearing from experts. The Federal Reserve is expected to decrease its target rate twice in 2025. Typically, a decrease in the Fed Rate goes hand in hand with a decrease in the mortgage rate. However, after the most recent Fed Rate cut, mortgage rates increased. At this time, the rate for a 30-year fixed mortgage is just above 7%. Expectations are that mortgage rates will be between 6%-6.5% by the end of the year. While those are much higher than the 3%-4% rates consumers enjoyed between 2020-2022, they are below the historical average. Mortgage rates averaged 7.72% from 1971 until 2025. Consumers have come to realize that mortgage rates are not going to decrease substantially in the coming years, and many are now concluding that the current rate is acceptable.

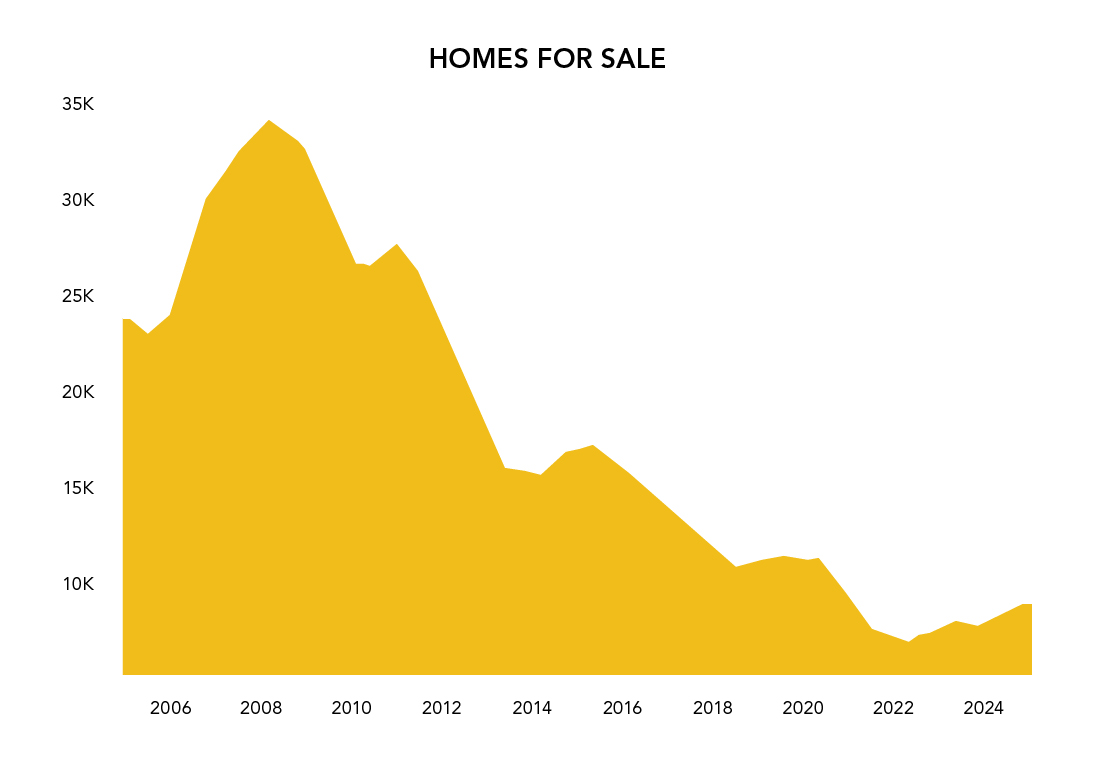

Inventory of Homes for Sale & Buyer Demand

Listing inventory is another factor we have written about often because it continues to have a massive impact on real estate sales and prices. In April 2008, in the midst of the Great Recession, there were about 34,048 homes for sale on MLS, which was the highest recorded number of active listings in history. In March of 2022, we recorded the lowest number of listings which was 6,811, nearly 400% fewer listings! There are indications that inventory is growing; in December 2024, there were 8,775 homes for sale, which is 14.8% more listings on the market than one year ago. We are hopeful this trend will continue and provide more choices for buyers. Buyer demand has a substantial impact on the supply of listings. As such, we will be watching the balance between buyer demand and listing supply closely in the coming months.

Lastly, we want to share that 2025 is a milestone year for Fazendin Realtors. Roger Fazendin founded the company in 1965. We continue to serve Twin Cities communities 60 years later! We are proud of the work we have done and grateful to those who have supported us over the years. We look forward to celebrating this impressive milestone throughout this year. Thank you for your trust and support, we have thrived in good markets and challenging markets thanks to you, our valued friends and clients. •